In today's economy, unexpected vehicle repairs like bodywork, dent removal, and paint jobs can be costly. Repair financing options offered by service providers act as a lifeline for consumers, easing financial strain and encouraging prompt maintenance. By covering these costs without depleting savings or incurring high-interest loans, these options ensure minor issues are addressed before escalating, ultimately promoting safer driving conditions and enhancing customer satisfaction in the auto repair industry. Advanced technology is expected to bring innovative financing models, making collision repairs more affordable.

In today’s digital age, consumers expect seamless experiences, and repair financing options have emerged as a game-changer. This article explores the growing need for flexible payment solutions in the repair industry. We delve into real customer stories, showcasing how access to repair financing alleviates financial strain during unforeseen repairs. Furthermore, we analyze the impact of these options on customer satisfaction and predict their evolving role in shaping future service expectations.

- Understanding the Need for Repair Financing Options

- Real Stories: How Customers Benefit from These Services

- The Impact and Future of Repair Financing in Customer Service

Understanding the Need for Repair Financing Options

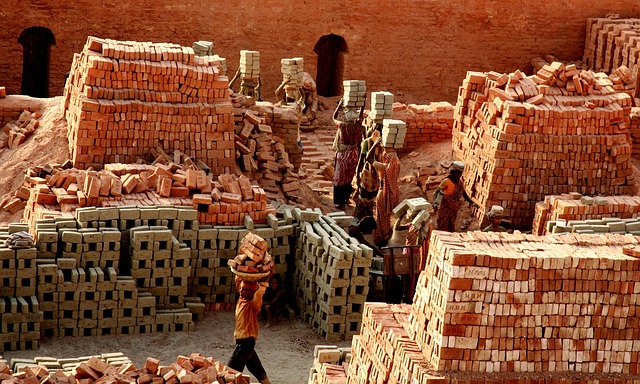

In today’s economic climate, many consumers find themselves facing unexpected financial hurdles when it comes to vehicle maintenance and repairs. This is particularly true for costly procedures like vehicle bodywork, dent removal, or vehicle paint repair, which can significantly strain household budgets. Recognizing this growing need, providers of repair financing options have stepped in to offer flexible payment plans that make quality car care more accessible. These financial solutions are designed to alleviate the financial burden associated with unexpected repairs, ensuring that vehicle owners can maintain their mobility and safety without the added stress of immediate, large expenses.

By providing repair financing options, businesses not only cater to a crucial aspect of consumer needs but also encourage customers to address essential vehicle maintenance promptly. This proactive approach fosters a safer and more reliable driving environment as issues like dents or damaged paintwork, if left unattended, can escalate into more serious problems.

Real Stories: How Customers Benefit from These Services

When it comes to unexpected repairs, many customers find themselves daunted by the financial burden. This is where real stories of repair financing options come into play, showcasing how these services can transform a stressful situation into a manageable one. Take Sarah’s experience for instance; she recently had to get her beloved car fixed after an accident, which included extensive auto body shop repairs and an auto dent repair. Without the repair financing option offered by her insurance provider, the cost would have been a significant strain on her budget.

Through this financing program, Sarah was able to pay in installments, ensuring she didn’t have to dip into her savings or take out a loan with high-interest rates. Similar tales are common among customers who avail of these services. They speak to the convenience and peace of mind offered by repair financing options, allowing them to focus on their daily lives without the constant worry of mounting car repair bills. This not only benefits individual consumers but also contributes to the overall accessibility and satisfaction within the auto repair industry.

The Impact and Future of Repair Financing in Customer Service

The introduction of repair financing options has significantly transformed customer experiences in the auto industry, particularly in areas like car paint services and auto bodywork. Customers now have greater accessibility to financial support for essential vehicle collision repairs, enabling them to take care of damages promptly without the immediate burden of high costs. This shift is pivotal in enhancing customer satisfaction and loyalty.

Looking ahead, the future of repair financing holds immense potential. As technology advances, innovative financing models could become more prevalent, offering tailored solutions for various auto repair needs. Such developments will not only make vehicle collision repair more affordable but also streamline the process, fostering a seamless experience for customers requiring car paint services or auto bodywork restoration.

In today’s economic climate, access to flexible repair financing options plays a pivotal role in enhancing customer satisfaction and loyalty. As highlighted in real-life narratives, these services empower consumers to make necessary repairs without incurring immediate financial strain. The positive impact extends beyond individual households, fostering a more robust and resilient community. Looking ahead, the evolution of repair financing options promises to revolutionize customer service, ensuring that quality maintenance becomes a reality for all, thereby enriching our living environments and strengthening the fabric of society.