Explore various repair financing options from banks, credit unions, and online lenders for diverse home improvement projects. Assess your creditworthiness, thoroughly review contracts, compare interest rates, repayment periods, and hidden fees to secure favorable terms. For vehicle body repairs, compare lenders' offers based on needs (short-term or long-term), interest rates, repayment periods, and eligibility rules. Choose an option aligned with project scope and timeline.

Struggling with home repair costs? Don’t let financial hurdles stand in the way of necessary fixes. This guide navigates the world of repair financing options with best terms, empowering you to explore diverse loan choices tailored for your needs. From understanding key terms and conditions to comparing lenders, you’ll discover strategies to secure favorable loans for your home repairs, ensuring a smooth and stress-free process.

- Explore Loan Options for Home Repairs

- Understanding Repair Financing Terms and Conditions

- Compare Lenders for Favorable Repair Loans

Explore Loan Options for Home Repairs

When it comes to tackling home repairs, financing options can be a lifesaver. There are various loan types designed specifically for homeowners looking to upgrade or fix their living spaces. From redoing your kitchen to repairing roof damage, understanding repair financing options ensures you have the funds needed without breaking the bank. Start by evaluating your creditworthiness, which will help determine the best loan terms and interest rates available to you.

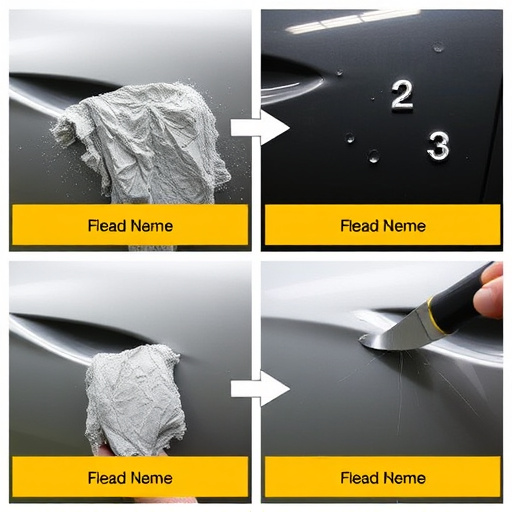

Many financial institutions offer loans tailored for home repairs, including banks, credit unions, and online lenders. These options can cover a wide range of projects, from structural changes to aesthetic upgrades. For instance, if you need to fix that old car body shop damage or perform extensive autobody repairs, specialized financing might be accessible. Exploring these repair financing options will enable you to make informed decisions, ensuring the best terms and conditions for your specific home improvement needs.

Understanding Repair Financing Terms and Conditions

When exploring repair financing options, it’s crucial to understand the terms and conditions attached to each offer. This involves carefully reading through contracts and agreements to grasp interest rates, repayment periods, and any hidden fees. Different lenders or service providers may use varied terminologies for similar concepts; for instance, “repair financing” could refer to a loan for car bodywork repairs or collision repair services. Therefore, take the time to clarify these terms to avoid surprises later.

Knowing what constitutes a “best term” requires comparing multiple offers based on their transparency and customer-friendly policies. For example, some lenders might offer lower interest rates but with shorter repayment periods, while others could provide longer repayment plans at slightly higher rates. Balancing these factors helps in securing the most favorable conditions for your car repair services, ensuring you get the best value for your investment without unnecessary financial strain.

Compare Lenders for Favorable Repair Loans

When shopping for repair financing options, it’s wise to compare lenders and their terms for collision repair or vehicle body repair work. Each lender may offer slightly different interest rates, repayment periods, and eligibility criteria. Start by identifying your specific needs; whether you’re looking for a short-term loan for immediate repairs or a longer-term option to spread out payments. Then, explore various financial institutions, including banks, credit unions, and online lenders, who specialize in repair financing.

Examine the terms of each lender carefully. Look at the interest rate, which can be fixed or variable, and consider how it will impact your overall cost. Compare the loan limits and minimum and maximum repayment periods to ensure the lender’s terms align with your project’s scope and timeline. Additionally, assess any hidden fees or additional requirements that might affect the affordability of your chosen repair financing option for collision repair or vehicle body repair work.

Finding the right repair financing options can be a game-changer for homeowners looking to transform their spaces. By exploring various loan types, understanding key terms and conditions, and comparing lenders, you can secure favorable terms tailored to your needs. With diligent research and strategic considerations, you’ll be well-equipped to embark on your home improvement journey without the financial burden. Remember, navigating repair financing is a crucial step towards enhancing your living environment and creating the home of your dreams.