Understanding repair financing options involves considering application fees, interest rates for creditworthy borrowers and specific repair types, plus bodywork service costs. Don't overlook hidden fees like administrative charges. Optimize costs by comparing lenders, negotiating with shops, and leveraging partnerships for reduced fees or promotions to make informed decisions.

Understanding the fees behind repair financing options is crucial for making informed decisions. This guide explores common and hidden costs associated with these services, empowering consumers to navigate the market effectively. We delve into the intricacies of various charges, from application fees to interest rates, offering strategies to optimize expenses. By understanding these financial aspects of repair financing options, folks can make sure they get the best deals and avoid costly surprises.

- Exploring Common Fees in Repair Financing

- Decoding Hidden Costs: A Comprehensive Look

- Strategies to Optimize Repair Financing Costs

Exploring Common Fees in Repair Financing

When exploring repair financing options, understanding the associated fees is crucial for making an informed decision about your vehicle’s upkeep. Common fees in repair financing can include application fees, which are typically charged by lenders to process your application and assess the risk of lending to you. These fees usually range from a few dollars to a percentage of the loan amount.

Other recurring charges involve interest rates, which represent the cost of borrowing money over time. The interest rate on repair financing options can vary significantly based on factors like your creditworthiness, the lender, and the type of repair needed—for instance, auto maintenance or automotive collision repair. Car bodywork services, such as painting or body repairs, may incur additional fees related to parts, labor, and disposal of old materials, all of which contribute to the overall cost of repairing your vehicle.

Decoding Hidden Costs: A Comprehensive Look

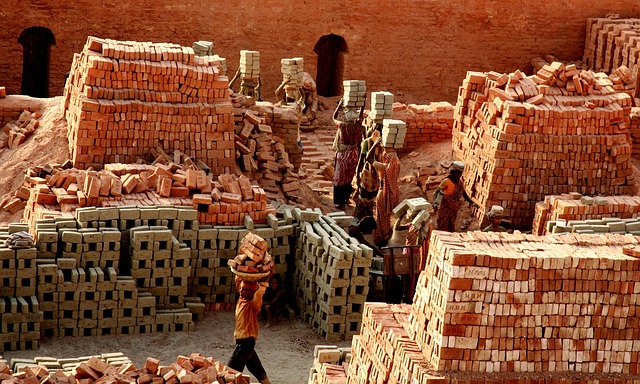

When exploring repair financing options, it’s easy to focus solely on the upfront cost and monthly payments. However, understanding the full scope of associated fees is crucial for making an informed decision. Beyond the obvious charges for parts and labor, there are often hidden costs that can significantly impact your overall expense. These might include administrative fees, processing charges, or even interest rates, which can vary between financing providers.

For instance, some repair shops may offer attractive pricing for services like frame straightening or paintless dent repair as part of their financing packages. But be mindful; these deals could come with additional surcharges or fees that are only revealed upon closer inspection. Whether it’s a vehicle collision repair or a simple aesthetic fix, ensuring transparency and comprehending all costs is essential to avoid surprises down the line.

Strategies to Optimize Repair Financing Costs

When considering repair financing options, optimizing costs can help reduce the overall financial burden. One effective strategy is to compare multiple financing providers and their associated fees. Each lender may have different interest rates, terms, and conditions, so shopping around allows you to find the most cost-effective solution for your needs. For instance, some lenders might offer lower rates for specific types of repairs, like a fender repair or luxury vehicle repair, which could significantly impact the overall financing costs.

Additionally, negotiating with auto repair shops can lead to better deals. Many shops partner with multiple financing providers and may be able to offer in-house financing with reduced fees or special promotions. Being proactive and informed about these options can help you make more financial sense of repair expenses.

When considering repair financing options, being aware of and strategically managing associated fees is key. By understanding common costs, deciphering hidden ones, and implementing cost-saving strategies, you can make informed decisions to optimize your repair financing experience. Remember, a thorough assessment of these fees will help you choose the best option for your needs while minimizing financial strain.